Tax depreciation formula

In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws. The formula for calculating straight-line depreciation is as follows.

Tax Shield Formula Step By Step Calculation With Examples

Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where.

. For example if a company has an annual depreciation of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. Next determine the net income of the corporation which will also be available as a line item in the income statement. Ltd for the year ended December 2018 is Rs50000.

EBITDA stands for earnings before interest taxes depreciation and amortization. Figure out the assets accumulated depreciation at the end of the last reporting period. 10000 for the first year 16000 for the second year 9600 for the third year and.

Profit before tax example. Firstly the taxable income of the individual and taxable earnings of the business entity is to be determined. SYD depreciation depreciable base x remaining useful lifesum of the years digits.

On the contrasting Liabilities Equity side the 7 reduction in net income flows through to. Depreciation Formula and Calculator. However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below.

The effect of a tax shield can be determined using a formula. Firstly determine the total expense of the corporation which will be easily available as a line item just above the net income in its income statement. Corporate tax is imposed in the United States at the federal most state and some local levels on the income of entities treated for tax purposes as corporations.

It is computed as the residual of all revenues and gains less all expenses and losses for the period. The cost of the fixed asset is 5000. As such businesses can take advantage of an upfront tax deduction by accelerating the.

PPE will decrease by 10 from the depreciation while cash will be up by 3 on the assets side. Profit before tax EBIT Interest expenses. EBITDA - Earnings Before Interest Taxes Depreciation and Amortization.

Next the tax-adjusted value is calculated by subtracting the tax rate from one ie. Profit before tax Revenue Cost of goods sold Operating expenses Interest expenses. Here is an example to show you how the profit before tax formula is calculated.

Essentially when put as an equation the depreciation formula looks like this. Marginal Tax Rate US. We welcome your comments about this publication and your suggestions for future editions.

Updated Study Notes and Revision Kits MASOMO MSINGI PUBLISHERS. The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. Finally the formula for depreciation can be derived by dividing the difference between the asset cost step 1 and the accumulated depreciation step 8 by the useful life of the asset step 3 which is then multiplied by 2 as shown below.

1 Tax rate. This means the van depreciates at a rate of 5000 per year for the. In the United States residential rental buildings are depreciable over a 275 year or 40-year life other buildings over a 39 or.

The new law changed depreciation limits for passenger vehicles placed in service after Dec. In this article we have primarily discussed the simple tax multiplier where the change in taxes only impacts consumption. The formula for a corporation can be derived by using the following steps.

Hence depreciation for plant and machinery is shown as under. To increase cash flows and to further increase the value of a business tax shields are used. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Therefore the tax base opening balance as per IT Act is. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of. For example suppose company B buys a fixed asset that has a useful life of three years.

Purchase or acquisition price of the asset - estimated salvage value of asset useful life of asset straight-line depreciation. 35000 - 10000 5 5000. In business and accounting net income also total comprehensive income net earnings net profit bottom line sales profit or credit sales is an entitys income minus cost of goods sold expenses depreciation and amortization interest and taxes for an accounting period.

NW IR-6526 Washington DC 20224. Depreciation Tax Shield Example. And depreciation for the same accounting period is Rs.

Profit before tax PBT is a line item in a companys income statement that measures profits earned after accounting for operating expenses like COGS SGA Depreciation Amortization etc non-operating expenses Non-operating Expenses Non operating expenses are those payments which have no relation with the principal business. Once purchased PPE is a non-current ie. Cumulative depreciation for tax purposes is Rs 90 and the tax rate is 25.

Generally no depreciation tax deduction is allowed for bare land. The profit before tax formula is as follows. Sum of Years Digits Depreciation Formula.

Tax Shield Formula. To convert this from annual to monthly depreciation divide this result by 12. If the taxpayer doesnt claim bonus depreciation the greatest allowable depreciation deduction is.

Formula for calculating straight-line depreciation. Ie the 10 in depreciation x 30 tax rate. This formula is simply the tax rate multiplied by the taxable income of the business or individual.

Formula for Calculating Depreciation by Straight-Line Method. The rate of depreciation is 50 and the salvage value is 1000. Read more are bifurcated into seven brackets based on their taxable income.

A good accountant or financial consultant can play a big role in helping each individual investor extract the most benefit afforded by the tax code and this kind of help can pay for itself many times over in tax savings. The formula to calculate depreciation under SYD method is. Say the profit before depreciation and tax for Kapoor Pvt.

2017-2020 Tax Code Changes and Updates. Since January 1 2018 the nominal federal corporate tax rate in the United States of America is a flat 21 due to the passage of the Tax Cuts and Jobs Act of 2017State and local taxes and rules vary by. For the double-declining balance method the following formula is used to calculate each years depreciation amount.

Finally the formula for net operating profit after tax is derived by multiplying the EBIT with the value calculated in step 2 as shown above. Profit Before Tax Definition. Now the companys tax rate is noted from the companys annual report.

On the other hand as per the tax code they can employ Accelerated depreciation is a way of depreciating assets at a faster rate. EBITDA is one indicator of a companys. Formula to calculate profit before tax.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. By using the formula for the straight-line method the annual depreciation is calculated as. Following is the formula for sum of years digits method.

Straight-Line Method Rate of Depreciation Original Cost Residual Value Useful Life x 100.

Depreciation Schedule Formula And Calculator Excel Template

What Is A Depreciation Tax Shield Universal Cpa Review

Depreciation Macrs Youtube

Free Macrs Depreciation Calculator For Excel

Depreciation Schedule Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Macrs Depreciation Calculator With Formula Nerd Counter

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

The Mathematics Of Macrs Depreciation

Depreciation Formula Calculate Depreciation Expense

Accelerated Depreciation Method Double Entry Bookkeeping

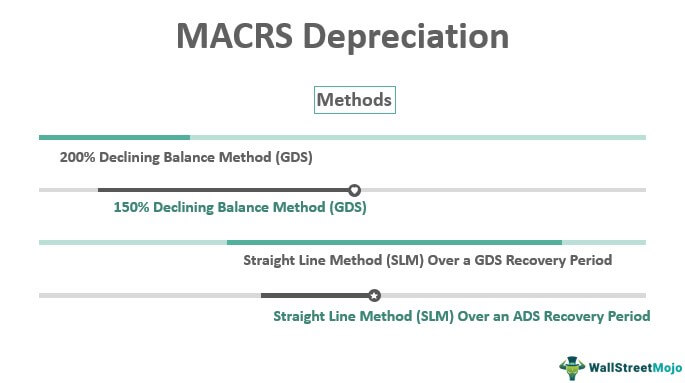

Macrs Depreciation Definition Calculation Top 4 Methods